About Us

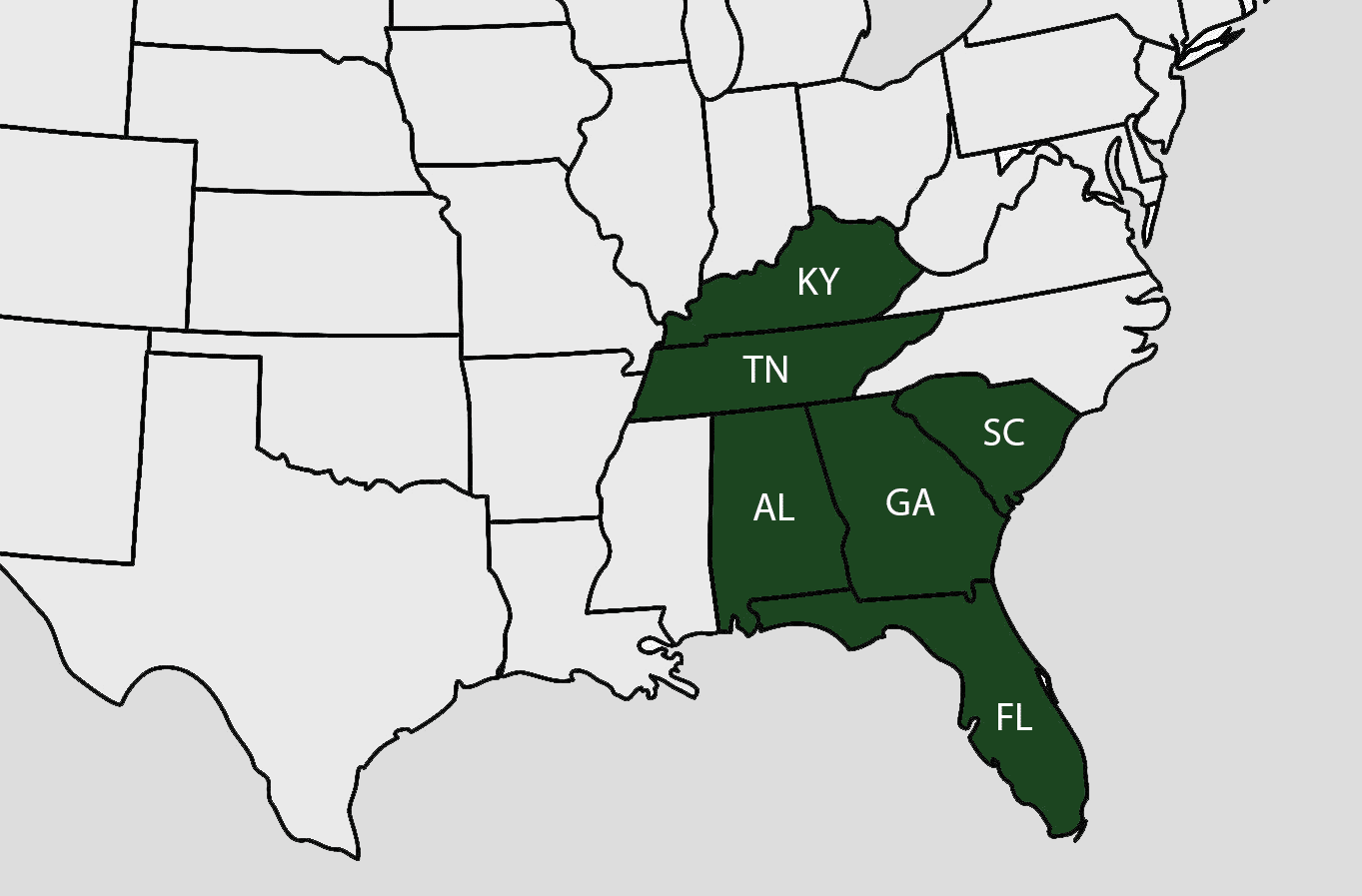

Standifer Capital is an Opportunistic Real Estate Investment Company focused on unlocking value in real estate across the Southeast. Standifer Capital uses its targeted acquisition criteria and intensive asset-level due diligence to identify compelling opportunities.

Standifer Capital then leverages its institutional management strategies to meaningfully improve properties to achieve above-market performance for all stakeholders while also improving the lives of residents and community members.

The Standifer Way

Institutional Discipline

Entrepreneurial Approach

Transparency

Results Focused

Data driven

Environmentally and socially conscious

0

States

0

Properties

0

Units

$

0

M

Transaction Value

Our Expertise

Investment Criteria

Location

Opportunity

Size

Our Team

Mike Sanghvi is a Co-Founder and Managing Partner overseeing the Acquisitions, Dispositions, and Portfolio Management of Standifer Capital. Prior to starting Standifer Capital, Mr. Sanghvi was doing Originations and Acquisitions at Canyon Partners Real Estate, a national investment firm focused on financing and developing properties across all asset classes. During his tenure at Canyon, Mr. Sanghvi completed transactions totaling over $1.8 billion, including $1.3 billion of multifamily transactions. Prior to Canyon, Mr. Sanghvi worked in Investment Banking at Deloitte and Morgan Stanley. Mr. Sanghvi graduated Summa Cum Laude from the University of California, Los Angeles with a B.A. in Business Economics. Mike is active with Urban Land Institute (ULI) and UCLA Real Estate Alumni Group and enjoys traveling internationally, skiing, and rooting for the UCLA Bruins.

Mike Sanghvi

Co-Founder & Managing Partner

Michael Vaysman is a Co-Founder and Managing Partner overseeing the Acquisitions, Dispositions, and Portfolio Management of Standifer Capital. Prior to starting Standifer Capital, Mr. Vaysman worked at Marble Partners, a Los Angeles based real estate fund focused on acquiring value-add multifamily assets in primary and secondary markets across the U.S. While at Marble, Mr. Vaysman oversaw the direct acquisition and investment of over 2,000 multifamily units. Additionally, Mr. Vaysman has been involved in a wide array of real estate acquisitions across all asset classes while working at a privately held real estate investment company. Mr. Vaysman graduated Summa Cum Laude from the University of California, Los Angeles with a B.A. in Economics and Accounting. Mr. Vaysman is active with several Los Angeles based organizations including The Guardians of the Los Angeles Jewish Home and Bruin Professionals.

Michael Vaysman

Co-Founder & Managing Partner